SZ's role in the 'clean energy arms race'

Writer: Lin Min | Editor: Zhang Chanwen | From: Shenzhen Daily | Updated: 2023-10-23

Days after the United States imposed additional limits on the kinds of semiconductors that American companies can sell to Chinese firms, China announced Friday that it would restrict exports of three categories of graphite — a mineral crucial to the manufacture of batteries for electric vehicles (EVs) — from Dec. 1.

In July, China imposed export restrictions on gallium and germanium, two minerals essential for making semiconductors.

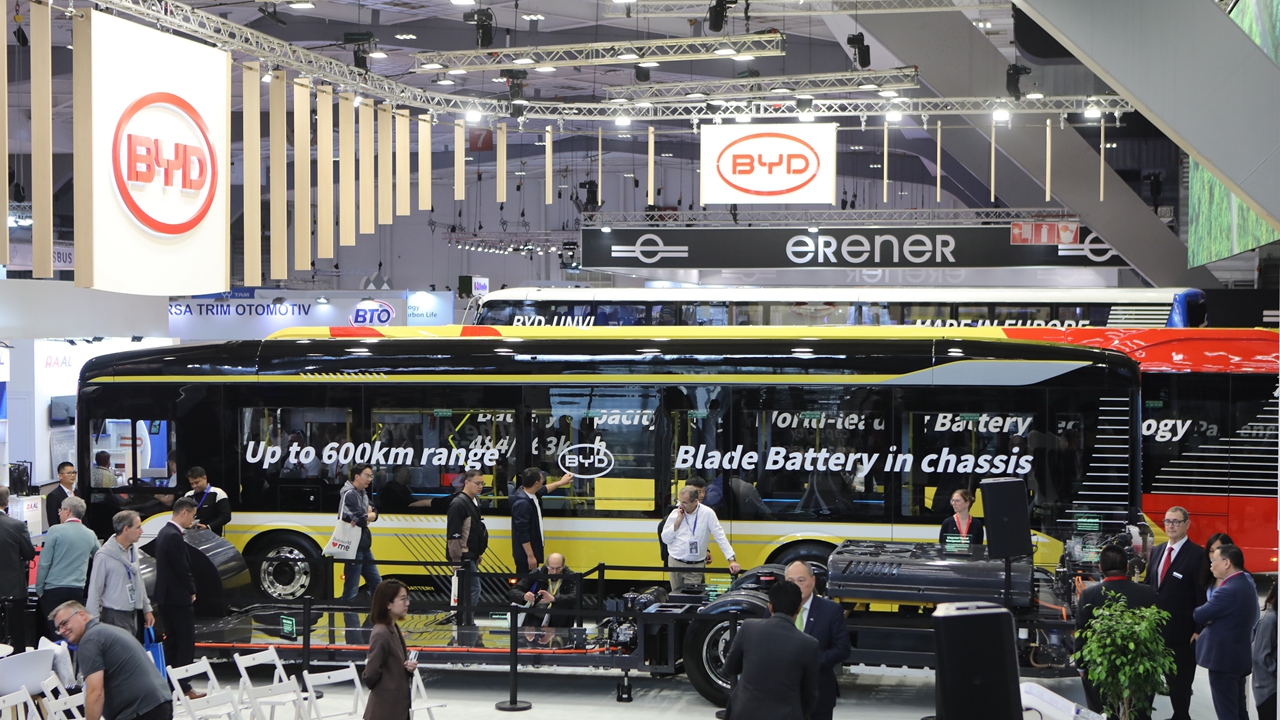

Electric buses produced by Shenzhen-headquartered BYD are seen at Busworld Brussels 2023 in Brussels, Belgium, on Oct. 7. Xinhua

China’s export curbs on the strategic minerals sent a clear signal to the Biden administration that the U.S. chip restrictions on China will not come without a price. Overseas observers also regard China’s actions as a tit for tat. “Newton’s third law that every action causes a reaction applies here, too,” Stefan Legge, head of tax and trade policy research at the University of St. Gallen in Switzerland, said.

China’s export restriction on graphite will have wider ramifications if you consider Washington’s Inflation Reduction Act (IRA) that Joe Biden signed into law last August. The IRA, which aims to attract billions in investment across existing and future technologies in sectors such as wind and solar power generation, battery storage, electric vehicles, green hydrogen, and carbon capture, was designed to rival China’s globally leading clean energy supply chains in what is billed by overseas media as a “clean energy arms race.”

If anyone wants to know the status quo of the clean energy industry in China, he or she should look no further than Shenzhen. Shenzhen’s new energy sector, especially EV manufacturing, has witnessed explosive growth in recent years due to the city government’s strong policy and financial support to the sector, as well as the first mover advantages of BYD and the city’s EV industrial chain.

Visitors take an interest in BYD's new generation fully liquid cooling ultra charge at the International Digital Energy Expo in Shenzhen in this photo dated June 30. Xinhua

In the first nine months of this year, BYD sold 2.08 million new-energy vehicles, a whopping 76.23% growth over the same period of last year, on track to hit its target of selling 3 million units in 2023. In comparison, Tesla is expected to produce and sell 1.8 million this year.

BYD’s line of products also covers the SkyRail monorail system, solar power generation and energy storage, all essential for the transition to clean energy.

In a latest policy release aimed at accelerating a transition to EVs, Shenzhen has announced plans to build 150 supercharging stations by the end of the year, and 300 such stations by March 2024 to further facilitate ultra fast charging for EVs.

The program aims to establish “1-kilometer supercharging circles” in the city’s central districts by 2025 — where ultra fast charging stations can be found within a 1-km radius — and enable users to fully recharge their electric cars “within a cup of coffee’s time.” Through this program, Shenzhen, a world-class “City of Supercharging” in the making, will contribute to China’s carbon peaking and carbon neutrality initiatives.

Shenzhen was designated by the country to build a pilot demonstration zone four years ago, and one of the five strategic roles envisaged for the city is to be a pioneer city for sustainable development. The phenomenal growth of Shenzhen’s EV industry is in answer to that call.

With low-cost, high-quality products offered by industrial leaders like BYD, China’s clean energy industry is a boon to the world in combating climate change, which poses an existential threat to humankind. With over 10 years of overseas presence, BYD’s electric buses serve more than 400 cities in over 70 countries and regions, helping those cities reduce green house emissions. Its affordable electric cars are increasingly welcomed by overseas consumers for its high-quality batteries. Shenzhen’s numerous other enterprises in the clean energy sector, too, are offering solutions to help wean the world off fossil fuels.

Healthy competition among industrial players and countries like China and the U.S. will stimulate tech innovations and lead to lower-priced and higher-quality products. However, if the United States clings to its “small yard, high fence” strategy to curb China’s technological advancement, it will lead to more Chinese countermeasures, and render the world’s efforts to fight climate change more costly and less effective.

Geopolitical strife aside, Shenzhen offers a textbook lesson in fostering a transition to clean energy. Amid a “clean energy arms race,” Shenzhen welcomes cross-border cooperation and fair competition, which will make the world a better place.

(The author is a deputy editor-in-chief of Shenzhen Daily.)