A shopper's guide to shenzhen's 'instant tax refund' service

From: Original

China is expanding the coverage of instant tax refunds to improve the experiences of eligible visitors — both foreigners and compatriots from Hong Kong, Macao, and Taiwan. The policy, already piloted in Shanghai, Beijing, Guangdong, Shenzhen, Sichuan, and Zhejiang, was extended nationwide April 8, 2025, building on a slew of recent efforts by China to boost global exchanges and mobility, such as easing its visa policies, enhancing payment accessibility, and streamlining customs clearance.

Refund-upon-purchase

The “instant tax refund” policy is a service that allows eligible visitors to claim their tax refund on purchased items at participating stores, instead of waiting until they depart. After signing an agreement and pre-authorizing a credit card, eligible visitors can receive a cash prepayment in RMB for the full VAT refund amount.

To further streamline the departure tax refund process for eligible travelers, Shenzhen launched a new pilot program featuring a “one order, one bag” model at three designated malls April 27. Under the scheme, purchases and departure tax refund forms are packed together in sealed bags, enabling customs officials to quickly verify the packaging’s authenticity and cut inspection time by more than 50%.

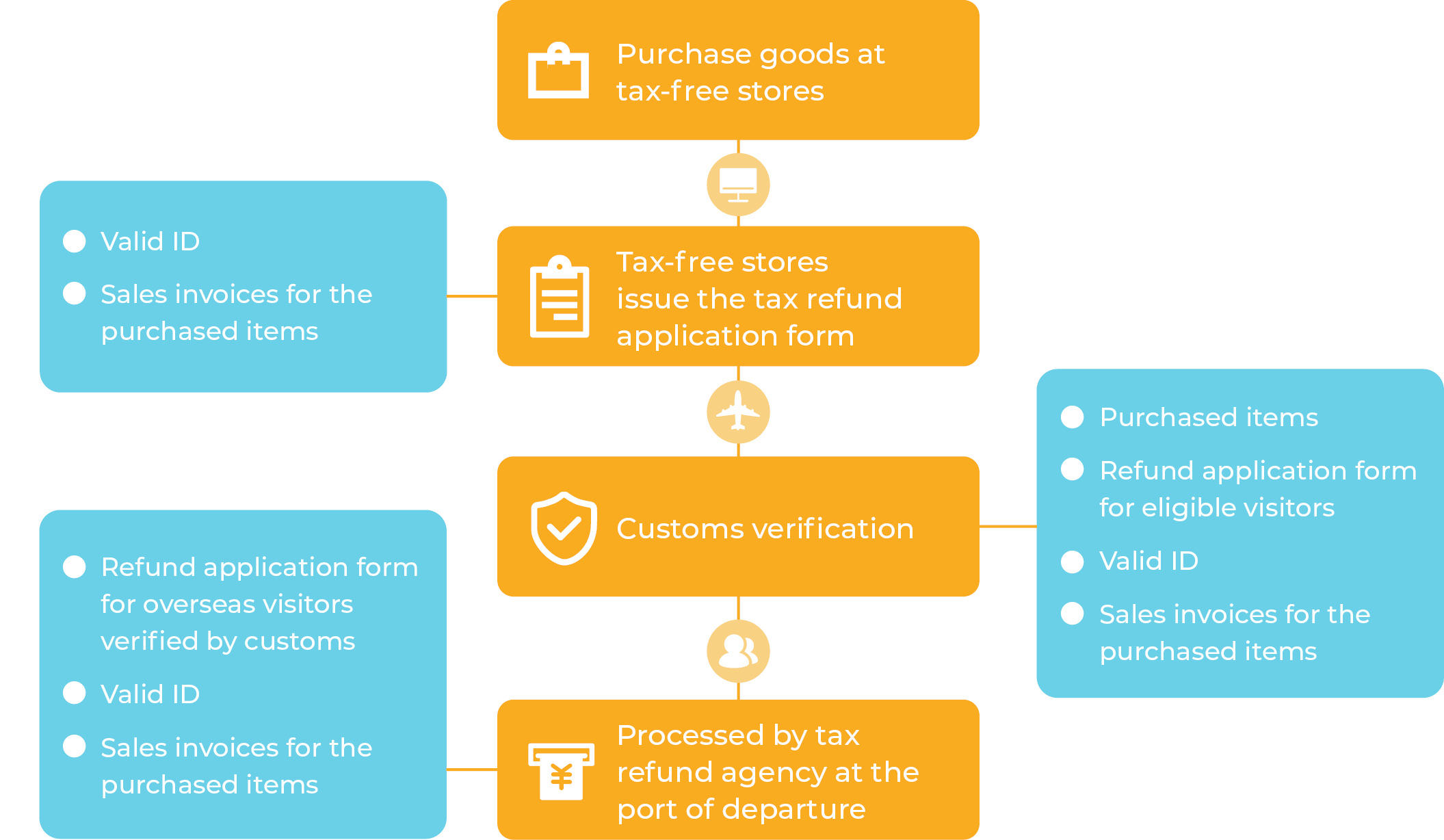

Refund-upon-departure flowchart

As of July 2, 2025, Shenzhen had a total of 12 centralized tax refund points across its key commercial districts and 1,000 tax-free stores, with more scheduled to open.

A traveler reads an English-language guide on the departure tax refund process at the Shenzhen Bay checkpoint.

Photos by Lin Jianping except otherwise stated

On June 27, the city designated the Futian and Shenzhen Bay checkpoints as new land-based duty-free ports for outbound travelers. This expansion has brought the total number of duty-free ports in the city to five, including the previously operational Wenjindu Checkpoint, Bao’an International Airport, and Shekou Cruise Terminal.

Ms. Kwan, a Hong Kong resident, receives an outbound tax refund at the Futian checkpoint June 27, becoming the first to use the newly launched service.

Shenzhen is now the city with the most customs ports offering the tax-refund-upon-departure service in the country.

Designated ports within Shenzhen:

• Wenjindu Checkpoint (land border) 文锦渡口岸

• Bao’an International Airport (air hub) 宝安国际机场

• Shekou Cruise Terminal (maritime gateway) 蛇口邮轮码头

• Futian Checkpoint (land border) 福田口岸

• Shenzhen Bay Checkpoint (land border) 深圳湾口岸

Meanwhile, the “Shenzhen Departure Tax Refund Self-service Miniprogram,” developed by the Shenzhen Tax Service, State Taxation Administration and the Guangdong Huaxing Bank, has been launched. Eligible visitors can fast-track the tax refund process online by scanning the above QR code.

A shopper is in the process of claiming her tax refund.

To make it easier for eligible visitors to apply for tax refunds, the State Taxation Administration has released “A Guide to the Departure Tax Refund for Overseas Visitors.” The guide, available in 14 languages including Chinese, English, Russian, and French, introduces the tax refund items, conditions, currency, and procedures for tax refunds.

Shenzhen’s “i口岸” (i Port) miniprogram has also launched a service to help eligible visitors easily and quickly search for departure tax refund information and service locations.

A signboard indicating instant tax refund services in the Kingglory Plaza in Luohu District. Lin Songtao

The miniprogram is available in simplified Chinese, traditional Chinese, and English. Within it, the departure tax refund column presents Shenzhen’s departure tax refund policies, refund recipients, processing methods, departure tax refund amounts, and contact information in both Chinese and English.

Instant tax refunds: A step-by-step guide

Step 1: Shop at a designated store

Your shopping journey begins at stores designated as “即买即退” (Buy & Tax Refund) merchants. When a purchase at one of these stores exceeds 200 yuan (US$27.9), inform the staff that you need a tax refund, sign an agreement, and complete the credit card pre-authorization procedure.

Step 2: Visit the centralized refund point

Once you have finished shopping, go to the “instant tax refund” centralized service point within the store or shopping complex and claim your refund. Currently, tax refunds can be paid in cash, through a bank transfer, or through Alipay.

Step 3: Customs verification

When you are leaving the mainland, you must present your purchased goods, the refund application form for eligible visitors, invoices, and a passport or other valid form of ID to the customs verification counter.

Step 4: Review by a tax refund agency

You also need to provide a valid ID, the refund application form for eligible visitors verified and stamped by customs, and invoices to the tax refund agency within the quarantine zone at the port of departure. Once these requirements are met, the agency will lift the pre-authorization on the credit card and finalize the refund process, with the prepaid amount treated as the paid tax refund.

Guides to the departure tax refund for overseas visitors. Lin Jianping

Important info to know:

1. Eligible visitors comprise both foreigners and compatriots from Hong Kong, Macao, and Taiwan who have stayed on the Chinese mainland for no more than 183 consecutive days before the date of departure;

2. The departure date must be on or before the 17th day following the purchase;

3. The purchased items, valued between 200 yuan and 220,000 yuan, must be unused or unconsumed;

4. The purchased items must be carried by the visitor or packed in the visitor’s checked luggage upon departure;

5. If the amount of the tax refund is 20,000 yuan or less, either cash or bank transfer can be chosen. If it exceeds that amount, the tax refund shall be made through bank transfer;

6. The visitor shall hold a credit card available for pre-authorization;

7. For items with the applicable tax rate of 13%, the tax refund rate is 11%. For items with the applicable tax rate of 9%, the tax refund rate is 8%;

8. If a visitor does not depart on time or from a designated port, the tax refund agency will deduct the prepaid refund from the pre-authorized credit card within three working days after the assumed departure day. While the visitor departs, the agency at the departure port will process the tax refund according to current regulations.

12 CENTRALIZED TAX REFUND POINTS:

1. Sun Plaza

Add: No. 2001, Jiefang Road, Luohu District

2. The MixC

Add: No. 1881, Bao’an South Road, Luohu District

3. Kingglory Plaza

Add: No. 2028, Renmin South Road, Luohu District

4. COCO Park

Add: No. 268, Fuhua 3rd Road, Futian District

5. Shenzhen Bay MixC

Add: No. 2888, Keyuan Road, Nanshan District

6. K11 ECOAST

Add: Taizi Bay, Nanshan

District

7. MixC World

Add: No. 9668, Shennan Boulevard, Nanshan District

8. Uniwalk Qianhai

Add: No. 99, Xinhu Road,

Bao’an District

9. Haiya Mega Mall

Add: No. 99, Jian’an 1st Road, Bao’an District

10. Longhua Uniworld

Add: No. 4022, Renmin Road, Longhua District

11. Outlets 8

Add: No. 1, Minkang Road,

Longhua District

12. Dameisha Outlets 8

Add: No.1, Huanmei Road,

Yantian District