International conference in macroeconomics held at PHBS

Writer: | Editor: Stephanie Yang | From: | Updated: 2019-06-26

The Second China International Conference in Macroeconomics (CICM) was held from June 21 to 23 at the Peking University HSBC Business School(PHBS). The event was jointly sponsored and organized by PHBS, Tsinghua University PBC School of Finance (PBCSF) and China Forum of Macroeconomic Research (CFMR).

A group photo of the conference attendees. Photos by courtesy of PHBS

The annual event this year featured three keynote speeches, parallel academic sessions and a policy panel. Over 150 scholars, policymakers and practitioners worldwide including Nobel laureates Thomas Sargent (2011) and Lars Peter Hansen (2013) converged to present papers and discuss topics related to macroeconomics. This year’s acceptance rate from open submissions was 10.4%, out of 319 high-quality papers.

Hai Wen, dean of PHBS, gives opening remarks.

Dean of PHBS Hai Wen, Associate Dean of PBCSF Hao Zhou and CFMR President Miao Jianjun, delivered opening remarks. They emphasized on the importance of macroeconomic research and the aim of CICM in promoting international dialogue and exchanges.

Professor Wei Shangjin probed monetary policy based on global value chains and proposed a structural explanation for divergence between PPI (Producer Price Index) and CPI (Consumer Price Index ) measures. PPI reflects upstream sector inflation while CPI focuses more on final goods inflation. He pointed out that if only aggregate price indices can be chosen in the monetary policy making process, then targeting PPI instead of only targeting CPI improves welfare.

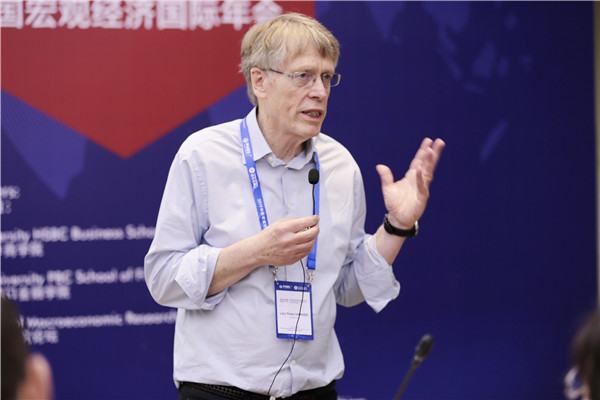

Lars Peter Hansen, 2013 Nobel Laureate in Economics,delivers a keynote speech.

In his keynote speech, Professor Lars Peter Hansen provided insights on the relationship between carbon emissions, climate change and price uncertainty. He used social valuation rather than private valuation and took climate change and the subsequent societal damage induced by economic activity as the “cash flow” to be valued. The results of the model show that when the global temperature rise exceeds the carbon budget (i.e., exceeds expectations), adverse effects of global warming on economic growth rate and the uncertainty of its impact will also increase rapidly.

Professor Mikhail Golosov provided a keynote address on “Inequality, Business Cycles and Monetary-Fiscal Policy.” His study examined optimal monetary and fiscal policy in a model with heterogeneous agents, incomplete markets, and nominal rigidities. In this context, agents differ in wages, exposures to aggregate shocks, holdings of financial assets, and abilities to trade assets, while incomplete financial markets prevent agents from fully insuring risks. He pointed out that the presence of trading frictions increases the importance of fiscal instruments.

In the policy panel, scholars, policy experts and practitioners (from China International Capital Corporation, Deutsche Bank AG Hong Kong Branch and J.P. Morgan), presented views on local and global economic issues. In addition, parallel academic sessions covered the main fields of China’s economic development, asset pricing, bank credit, monetary policy, and the labor market, among other topics.

Sargent and scholars listen to the keynote speeches.

The paper “Endogenous Price War Risks” earned the CICM Best Paper Award, coauthored by Winston Dou from the Wharton School of University of Pennsylvania, Ji Yan from Hong Kong University of Science & Technology (HKUST) and Wu Wei from Texas A&M University. It proved that in industries with higher capacity for radical innovation, firms' incentive for price undercutting are more immune to price war risks and long-run growth shocks. Hai presented the award.

This year’s CICM Best Junior Scholar Paper Award was granted to “Disruption of Long Term Bank Credit” by Jonathan Payne from Princeton University. The paper studied the disruption of bank business credit during a financial crisis in a model with optimal long term contracting under agency frictions and a directed search market for bank funding. Zhou Hao, Associate Dean of Tsinghua University PBC School of Finance presented the award.

Participants have a meeting at Huawei's headquarters.

Following the conference, participants were invited to visit Huawei's headquarters to meet with the company's Senior Vice President Lin Ruiqi.