Application for Chinese Tax Residency Certificate

Application Requirements

An enterprise or individual (hereinafter referred to as “applicant”) may apply for a Chinese Tax Residency Certificate (hereinafter referred to as “Tax Residency Certificate”) from a competent tax authority for the purpose of claiming tax benefits under tax treaties entered into by the Chinese Government and other countries or regions, including double taxation avoidance agreements (DTA) signed between the Chinese government and governments of other countries,DTA arrangements signed between the Mainland of China and China’s Special Administrative Regions of Hong Kong and Macao, DTA agreement between the mainland of China and China’s Taiwan, as well as air transport agreements, maritime transport agreements, road transport agreements, motor transport agreements, and agreements or letters for mutual exemption of tax on international transport income.

Legal Basis

Article 1 of the Public Notice of the State Taxation Administration on the Issuance of Chinese Tax Residency Certificate (issued by STA Public Notice [2016] No. 40 and amended by STA Public Notice [2018] No. 31)

Article 1 of the Public Notice of the State Taxation Administration on Revising Matters Relevant to Chinese Tax Residency Certificate (STA Public Notice [2019] No. 17)

Notes:

1. Taxpayers are responsible for the authenticity and legality of the materials submitted.

2. The information filled in or provided by the applicant shall be submitted in Chinese, and if the original copy of the relevant material is in foreign language, a Chinese translation shall be provided at the same time. When the applicant submits a printed copy of the above materials to the competent tax authority, the applicant’s seal or signature shall be affixed on the copy, and the competent tax authority shall keep the printed copy after verifying the original copy.

3. For materials not specified as original or printed copies in the “Materials Needed” list, the original copies shall be provided; for materials specified as printed copies, only printed copies shall be provided; for materials specified as original and printed copies, the printed copies will be collected and the original copies will be returned after verification.

4. The submitted printed copies must state its consistency with the original copies and be stamped with the company’s official seal.

5. Taxpayers may use e-signatures that meet the requirements of the Electronic Signature Law of the People’s Republic of China, which have the same legal effect as handwritten signatures or seals.

6. If the competent tax authority or the higher-level tax authority cannot make a judgment based on the materials submitted by the applicant, the applicant may be required to provide additional relevant materials andat one time shall be informed of what materials are additionally required in writing. The time for the applicant to provide additional information will not be included in the timeframe for the processing.

Service Channels

1. Tax Service Halls (Click to view the location, opening hours and contact information of the tax service halls)

“City-wide Universal Processing” services will be provided at all tax service halls except for theSecond Tax Bureau of Shenzhen Municipality.

2. Self-service tax terminal access is currently unavailable.

3. Online service

E-tax bureau (e-tax bureau) service access is available.

Mobile terminal (tax bureau) and WeChat (tax bureau) service is currently unavailable.

Processing Authority

The competent tax authorities

Processing Time

1. Time limit for taxpayers

N/A.

2. Time limit for tax authorities

The competent taxation authority shall close the application within 7 working days from the date of acceptance; if the competent tax authority cannot determine one’s resident status and needs to submit the application to the higher-level tax authority, the application shall be closed within 20 working days.

Tel.

Please refer to the tax service map for contact numbers of each tax service hall.

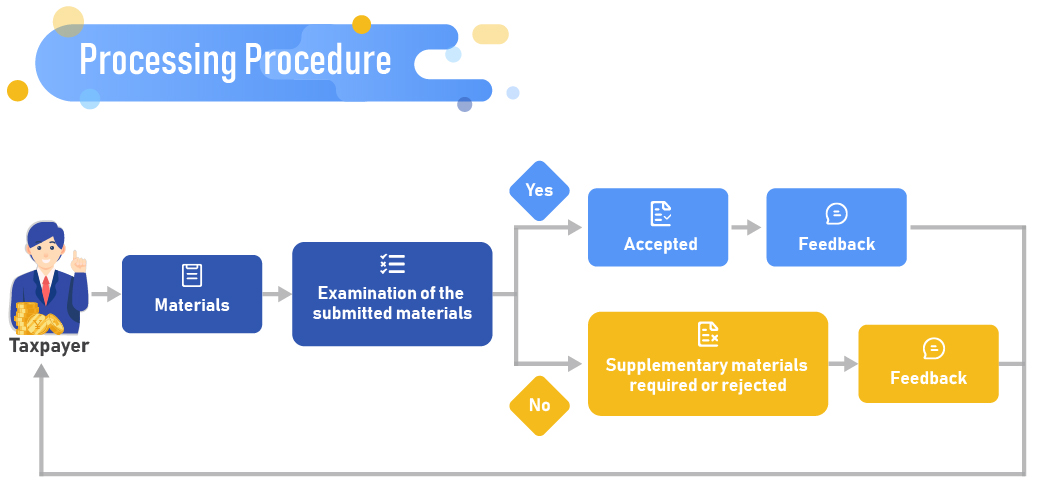

Processing Procedure

Processing Result

The tax authority will issue the Chinese Tax Residency Certificate.

Notices for Taxpayers

1. The tax authorities provide single-window service. Taxpayers need to visit the tax authorities only once at most on the precondition that the materials are complete and meet the legal requirements for acceptance.

2. A domestic or overseas branch of a Chinese resident enterprise shall apply to the competent tax authority through its head office at the place where its head office is domiciled. A partnership enterprise shall apply to the competent tax authority at the place where its Chinese resident partner is domiciled with its Chinese resident partner as the applicant.

3. If the competent tax authority of the other contracting party of the tax treaty has special requirementsfor the format of the Tax Resident Certificate, the applicant can provide a written explanation of the special requirements and the required application format of the Tax Resident Certificate.

Fees

Free of charge

Application Forms

The form can be downloaded from the “Tax Services” – “Download Center” – “Form Download” section of the Shenzhen Tax Service website, State Taxation Administration (specific download address) or collected from the tax service halls.

Instructions for Filling out Forms

Please see the instructions for filling out as shown in the relevant forms.